When considering purchasing land, one of the first steps you’ll need to take is determining how much you’ll need to pay each month for the land loan. This payment is known as the EMI (Equated Monthly Installment), which includes both the principal and the interest.

Whether you’re a first-time buyer or a seasoned investor, understanding how to calculate your land loan EMI is crucial for planning your finances and ensuring your budget can accommodate the monthly payments.

What is EMI and Why is it Essential for Land Loans?

EMI, or Equated Monthly Installment, is the fixed monthly amount you need to pay to your lender to repay your loan over a set period of time. For a land loan, your EMI is the combined amount of principal and interest you pay every month.

Why Knowing Your EMI Matters:

- Financial Control: Helps you plan your monthly budget and avoid financial strain.

- Loan Management: Knowing your EMI allows you to compare various loan options before committing to a lender.

- Future Planning: By calculating your EMI in advance, you can ensure your loan payments align with your long-term financial goals.

Understanding your EMI is vital for both budgeting and making informed decisions about loan tenure, interest rates, and principal amounts.

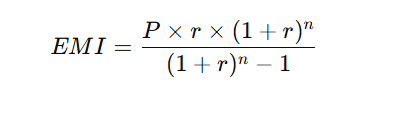

The Formula for Calculating Land Loan EMI:

The EMI formula helps you calculate the monthly installment you need to repay the loan.

The formula is: EMI=P×r×(1+r)n / (1+r)n−1

Where:

- P = Principal loan amount (the total amount you borrow).

- r = Monthly interest rate (annual rate divided by 12, and then by 100 to convert it into a decimal).

- n = Total number of months (loan tenure in months).

This formula helps determine how much you’ll be paying every month throughout the loan period, taking both the interest and principal repayment into account.

How to Calculate Your Land Loan EMI: A Real Example

Let’s use an example to show how the formula works in practice.

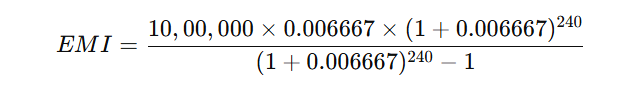

Example:

- Loan Amount (P): ₹10,00,000 (₹10 Lakh)

- Interest Rate (R): 8% per annum

- Loan Tenure (N): 20 years (240 months)

Step-by-Step Calculation:

Step 1: Convert the annual interest rate to a monthly rate.

r=8/12=0.6667%=0.006667 (monthly interest rate)

Step 2: Convert the loan tenure into months.

n=20×12=240 months

Step 3: Apply the formula to find the EMI.

EMI=10,00,000×0.006667×(1+0.006667)240 / (1+0.006667)240−1

Result: The monthly EMI will be approximately ₹8,374.

This means that for a ₹10 lakh loan at 8% interest over 20 years, your monthly payment will be ₹8,374.

Factors That Influence Your Land Loan EMI

The EMI isn’t just determined by the loan amount and tenure; several other factors play a role in shaping the amount you’ll pay every month:

- Loan Amount (P): The higher the amount you borrow, the higher your EMI will be. More borrowed funds mean more monthly payments.

- Interest Rate (r): A higher interest rate means a higher EMI. Even a slight increase in the interest rate can result in significantly higher payments.

- Loan Tenure (n): A longer tenure results in a lower EMI, but you will end up paying more in interest over time. Conversely, a shorter tenure will lead to a higher EMI, but you’ll save on interest.

- Down Payment: If you can afford a larger down payment, you reduce the loan amount, which directly reduces your EMI.

Using an EMI Calculator for Instant Results

While understanding the formula is essential, calculating your EMI manually each time can be cumbersome. Fortunately, you can use online EMI calculators to simplify the process. By entering your loan details (amount, interest rate, and tenure), you can instantly calculate the EMI for your land loan.

Why Use an EMI Calculator?

- Time-Saving: Instantly calculate your EMI without manual computation.

- Accuracy: EMI calculators ensure that all calculations are correct and up-to-date with current interest rates.

- Comparison: Easily compare how different loan amounts, interest rates, and tenures affect your EMI.

Try the Land Loans Calculator to calculate your EMI instantly and see the full breakdown of principal and interest payments.

How to Lower Your Land Loan EMI

If you find the EMI to be higher than what you can afford, here are a few strategies you can use to lower your monthly payments:

- Increase Your Down Payment: A larger down payment reduces the loan amount, which directly lowers your EMI.

- Negotiate a Lower Interest Rate: Shop around and compare interest rates from different lenders to get the best deal.

- Choose a Shorter Tenure: Though this increases your EMI, a shorter tenure reduces the total interest paid over time.

- Opt for a Floating Interest Rate: A floating interest rate can initially be lower than a fixed rate, but it can fluctuate with market conditions. This could lower your EMI if interest rates drop.

Why EMI Calculation is Crucial for Your Financial Planning

Knowing how to calculate your land loan EMI is not just about understanding monthly payments; it’s about making smarter financial choices. Here’s why it matters:

- Helps You Budget: By calculating the EMI, you can ensure that your loan fits comfortably within your monthly income.

- Informs Loan Choices: You can compare loans with different interest rates, tenures, and amounts, allowing you to select the option that best aligns with your financial goals.

- Predictability: Knowing your EMI ensures that you won’t face any surprises when the bills come due.

Conclusion

Understanding how to calculate your land loan EMI for property purchase is essential for making informed financial decisions. By using the formula and online calculators, you can quickly determine your monthly repayment amount, plan your budget, and ensure your loan fits within your means.

Remember that your EMI is influenced by several factors such as loan amount, interest rate, and tenure. Always consider these factors before applying for a land loan. And if you need a quick, easy way to calculate your EMI, don’t forget to try the Land Loans Calculator.

Frequently Asked Questions (FAQ)

1. What is EMI in land loans?

EMI is the monthly installment you pay to your lender, which includes both the principal and the interest on the loan.

2. How can I calculate my EMI for a land loan?

You can calculate your EMI using the formula provided above or use an online calculator like the Land Loans Calculator.

3. Can I lower my land loan EMI?

Yes, you can lower your EMI by increasing your down payment, negotiating a lower interest rate, or shortening your loan tenure.

By following this guide, you now have a clear understanding of how to calculate your land loan EMI and the factors that influence it. Use the insights and tools provided to make smarter, more informed decisions when purchasing land. Happy planning!

Tracey is the creator of LandLoansCalculator.com, a trusted resource for accurate and easy-to-use land loan calculators. With a strong focus on clarity and reliability, Tracey is dedicated to helping users understand land financing with confidence. Her goal is to simplify complex calculations so buyers, investors, and professionals can make informed decisions quickly and efficiently.