Financing land works differently from taking out a mortgage for a home. One of the first things most buyers ask is: how do I calculate the monthly payment for a land loan?

The process is straightforward once you understand the formula and the factors that drive your payment: the loan amount, the interest rate, and the loan term.

The Basic Land Loan Payment Formula

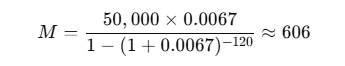

The standard formula for calculating monthly payments looks like this: M=P×r1−(1+r)−nM = \frac{P \times r}{1 – (1 + r)^{-n}}

Where:

- M = monthly payment

- P = loan amount (principal after down payment)

- r = monthly interest rate (annual rate ÷ 12)

- n = total number of payments (loan term in months)

This formula is used across most loan types, including mortgages, but the terms for land loans are often shorter and interest rates higher.

Step-by-Step Example

Let’s run through a simple example so you can see how it works:

- Loan amount (after down payment): $50,000

- Interest rate: 8% annually (0.08 ÷ 12 = 0.0067 monthly)

- Term: 10 years (120 months)

Result: The monthly payment is about $606.

How Loan Variables Change Your Payment

Interest Rate

- Higher interest = higher monthly payment.

- Even a 1% change can add or subtract hundreds over the life of the loan.

Loan Term

- Shorter term = higher monthly payment, less total interest.

- Longer term = lower monthly payment, but you’ll pay more interest overall.

Down Payment

- A larger down payment reduces the loan principal, which lowers the monthly payment.

Amortization: Principal vs. Interest

Your monthly payment is split between interest and principal repayment. Early payments go mostly toward interest, but over time, more of each payment reduces your balance.

A simplified amortization example for the $50,000 loan:

| Month | Principal Paid | Interest Paid | Balance |

|---|---|---|---|

| 1 | $269 | $337 | $49,731 |

| 2 | $271 | $335 | $49,460 |

| 3 | $273 | $333 | $49,187 |

Beyond the Formula: Other Costs

Your monthly land loan payment might also include:

- Property taxes – vary by state and county.

- Insurance – if required by the lender.

- HOA or maintenance costs – depending on the land’s location.

Some land loans may also have balloon payments or interest-only terms, which change how monthly costs are calculated.

Quick Tools

Manually using the formula works, but most buyers prefer to plug numbers into a land loan payment calculator to test different interest rates, terms, and down payment scenarios.

FAQs About Calculating Land Loan Payments

1. How do I figure out my monthly payment on a land loan?

Use the standard loan payment formula or an online calculator that handles land-specific loans.

2. Are land loan payments higher than home loan payments?

Yes, because terms are shorter and interest rates are usually higher.

3. Can I calculate payments without knowing the interest rate?

No, the interest rate is essential since it directly shapes your monthly cost.

4. Do property taxes and insurance count in the calculation?

Not in the base formula, but you should budget for them separately.

5. What if my land loan has a balloon payment?

Your monthly payments will be lower, but you’ll owe a large lump sum at the end of the term.

Final Takeaway

To calculate monthly land loan payments, you need three numbers: the loan amount, the interest rate, and the term. Apply them to the formula, or save time by using a calculator to test scenarios instantly.

Tracey is the creator of LandLoansCalculator.com, a trusted resource for accurate and easy-to-use land loan calculators. With a strong focus on clarity and reliability, Tracey is dedicated to helping users understand land financing with confidence. Her goal is to simplify complex calculations so buyers, investors, and professionals can make informed decisions quickly and efficiently.